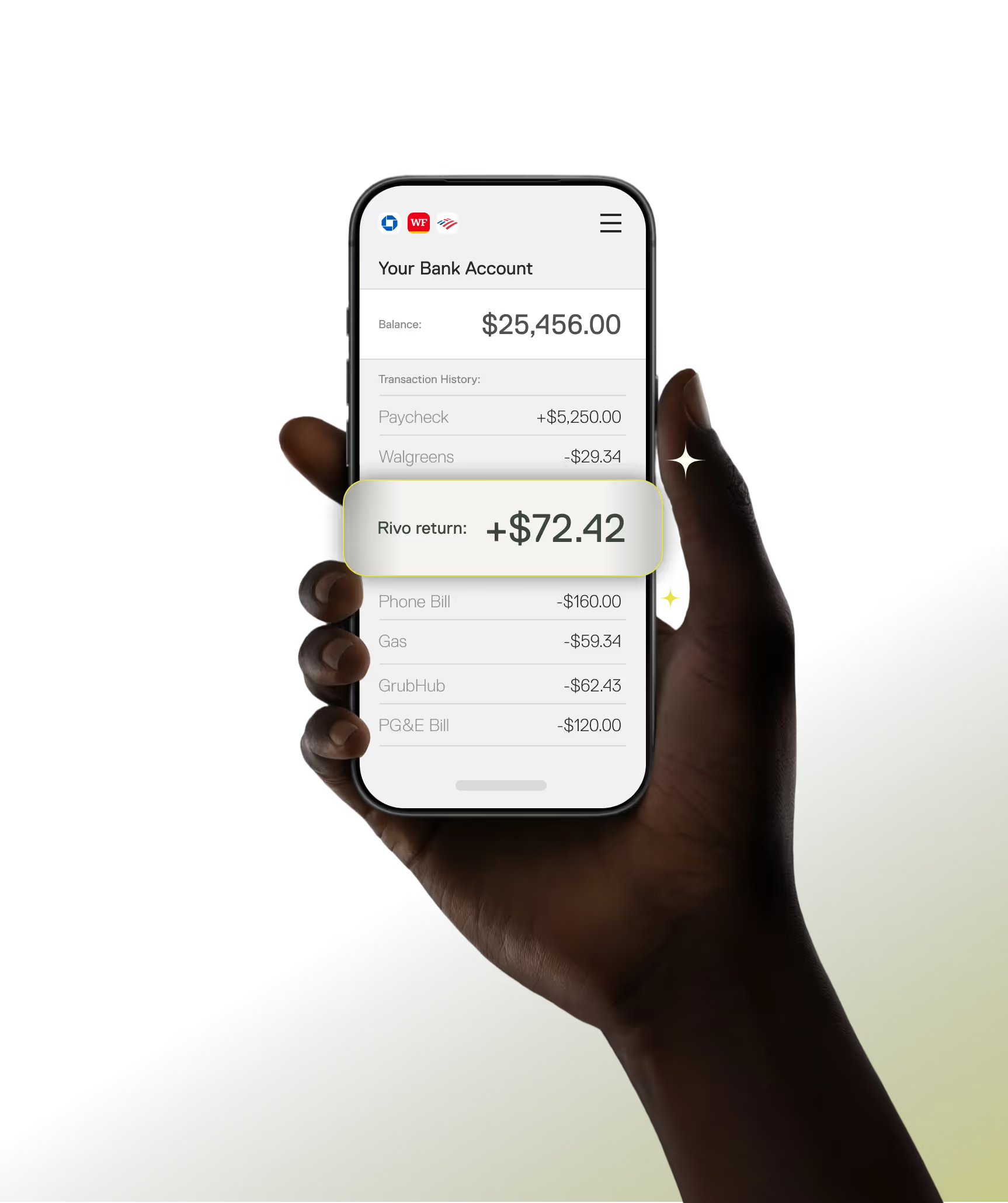

Keep your bank. Earn on every dollar.

Rivo puts the cash in your bank account to work, generating automatic earnings. No bank switching, no effort.

How works

Always on. Always earning money in the background.

Step 01:

Connect your bank securely

Link your checking account. Rivo analyzes your balance and learns spending patterns. Tell Rivo how much you always want in your account and it takes it from there.

Step 02:

Earning starts automatically

Your cash moves in and out of Rivo's high-yield account automatically. No lockups. Your money's always available when you need it.

Step 03:

Rivo plans around your bills

Rivo keeps enough cash in your bank account for your day-to-day spending. As bills and transfers approach, it moves money back into your account.

Safety, Security & Control

Your money is safe. And secure. And protected.

Safe, government backed accounts

Your cash goes into U.S. Treasury Bills, protected by SIPC insurance. Just like banks.

Pay zero state and local taxes

Interest from US Treasuries is exempt from state and local income taxes*, letting you keep more of your earnings, especially if you live in a high-tax area.

Always accessible

Funds stay liquid. Rivo moves money back into checking before bills or transfers hit, so it’s there when you need it.

Serious security

256-bit encryption, SOC 2 compliant infrastructure and bank-level security protocols protect every transaction.

Total control

Pause automations, move money yourself, or disconnect anytime. Rivo runs in the background; you’re still in charge.

Trusted team

Rivo was founded by a team of experienced AI and fintech builders who’ve spent decades building products for Fortune 100 in banking, automation and consumer trust.

Note: Nothing here is tax or investment advice—talk to your advisor about your specific situation. Interest earned from Treasuries is generally exempt from state and local taxes, but any capital gains from sale of Treasuries prior to maturity is not exempt.

See what your idle cash could be earning

With Rivo your cash grows at 50x the national average, without changing your bank.

Enter what you usually keep in checking and we’ll show you:

- What that cash might earn in a typical checking account

- What it could earn over time with Rivo quietly putting your cash to work.

Who We’re For

Built for people with full lives, who want their cash earning without lifting a finger.

Rivo is for you if:

You keep a healthy balance in the bank so nothing bounces

You know your money should earn more without you doing extra work

You’re juggling work, family, travel and a calendar that never quits

Testimonials:

Frequently Asked Questions

No. Rivo works with your existing bank accounts. It connects securely through Plaid and automatically optimizes your cash without requiring you to switch banks, move direct deposits, or modify your bill pay setup.

High-yield savings accounts require you to manually transfer money in and out and remember to do it regularly. Rivo handles everything automatically. You get the yield without the work, and your money is always back in checking when you need it.

No. Your idle cash goes into short-term U.S. Treasury Bills, which are considered among the safest places to hold cash in the world. This isn't the stock market, there's no volatility risk, the interest is backed by the full faith of the US government. You're simply earning yield on government-backed securities.

Yes. You can pause, modify, or stop any automation at any time through the app settings.

Yes. You can configure a minimum threshold for your checking account, ensuring that Rivo never moves more than you're comfortable with.